Financial data

Data relating to the usage of the protocol

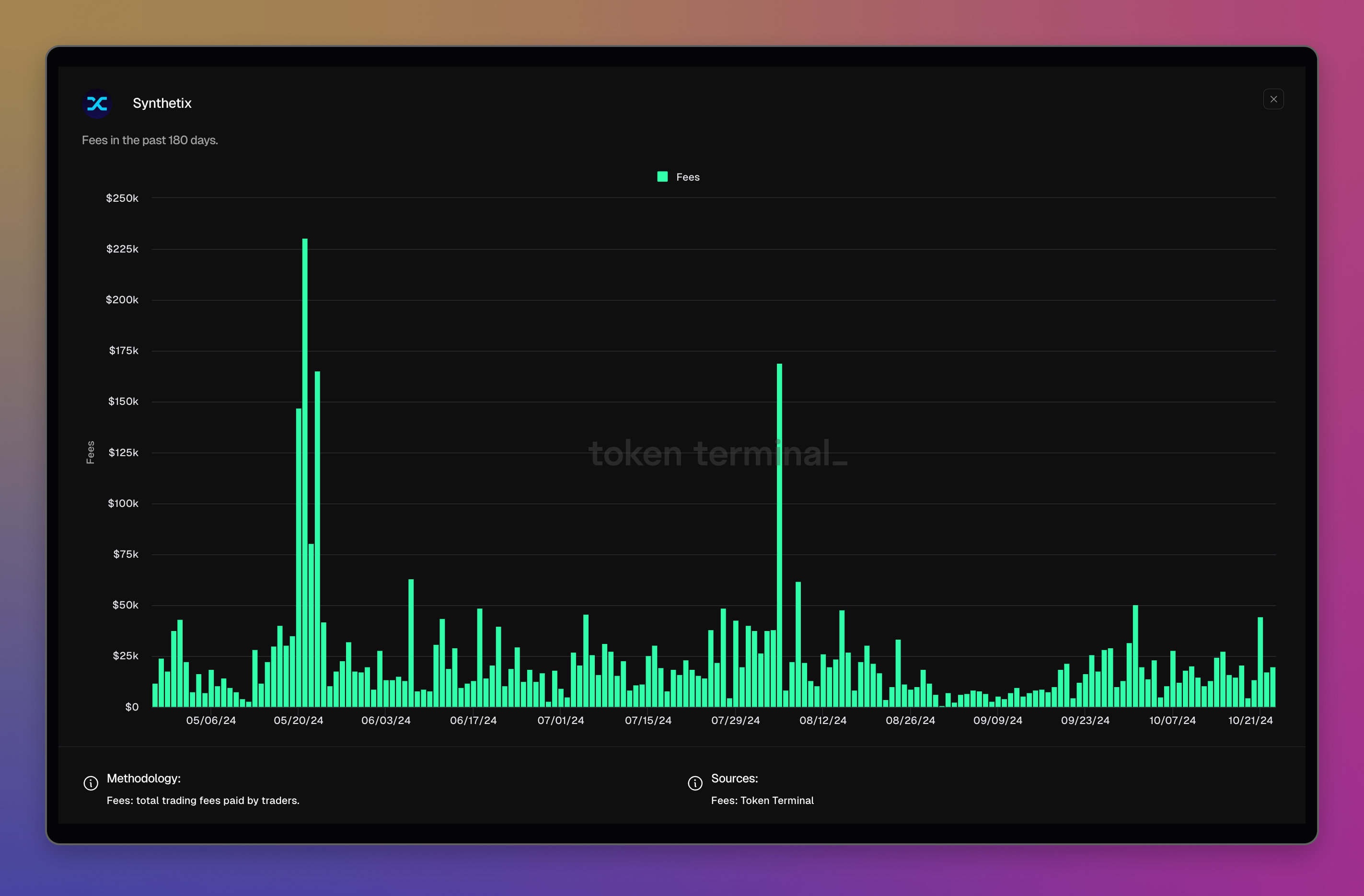

Fees

What is this metric: Fees paid by end users.

How it is calculated: Value of the aggregate fees paid by end users, sourced from onchain data.

Why do we show it: Shows if users are willing to pay to use a protocol, i.e. if there is product market fit (especially if there are no token incentives).

Example:

Synthetix dashboard: https://tokenterminal.com/terminal/projects/synthetix

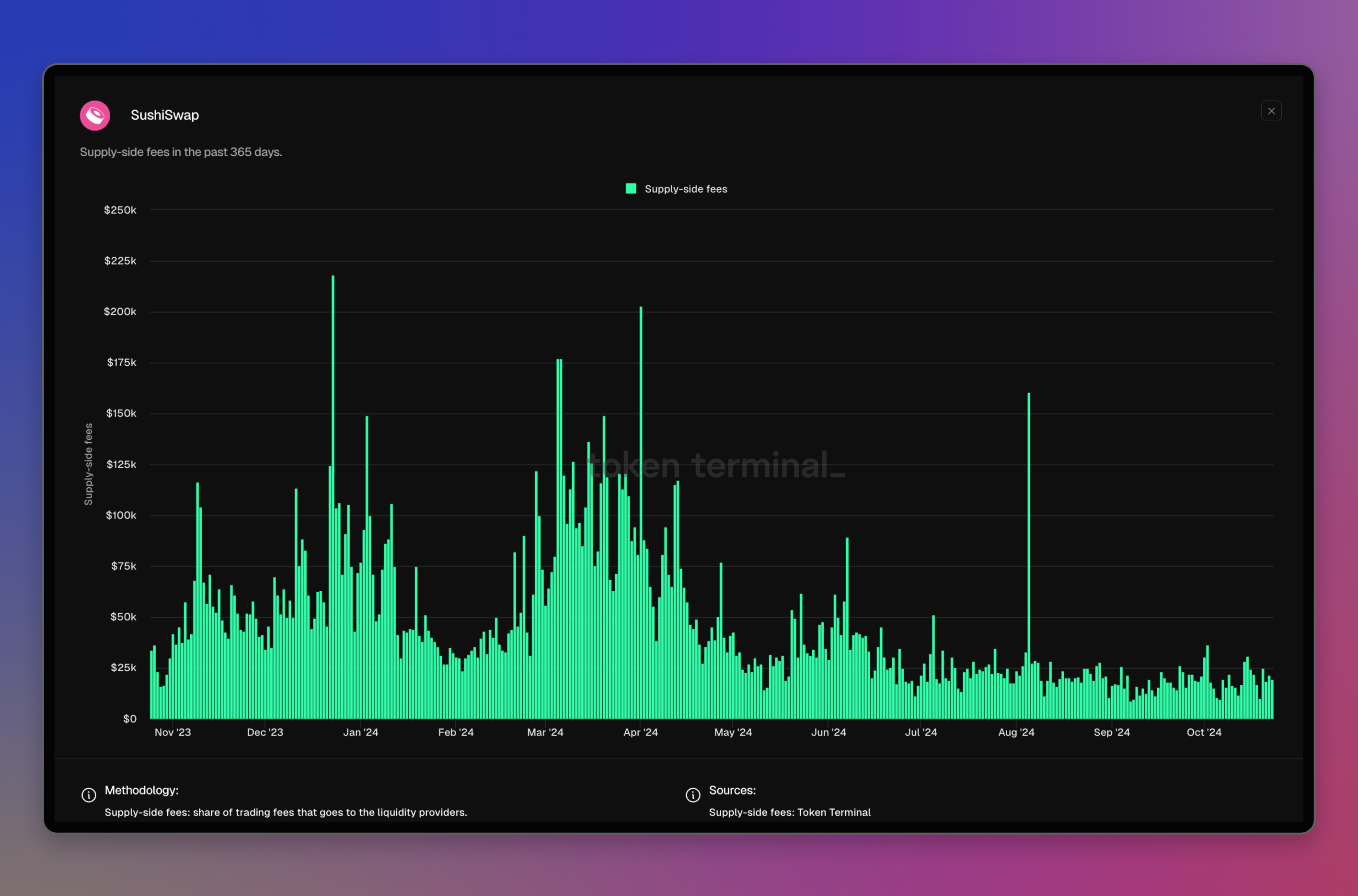

Supply-side fees

What is this metric: Portion of fees paid to service providers.

How it is calculated: Value of the fees paid to service providers (LPs, lenders, creators, etc.), sourced from onchain data.

Why do we show it: Shows what percentage of the fees the protocol passes on to service providers.

Example:

SushiSwap dashboard: https://tokenterminal.com/terminal/projects/sushiswap

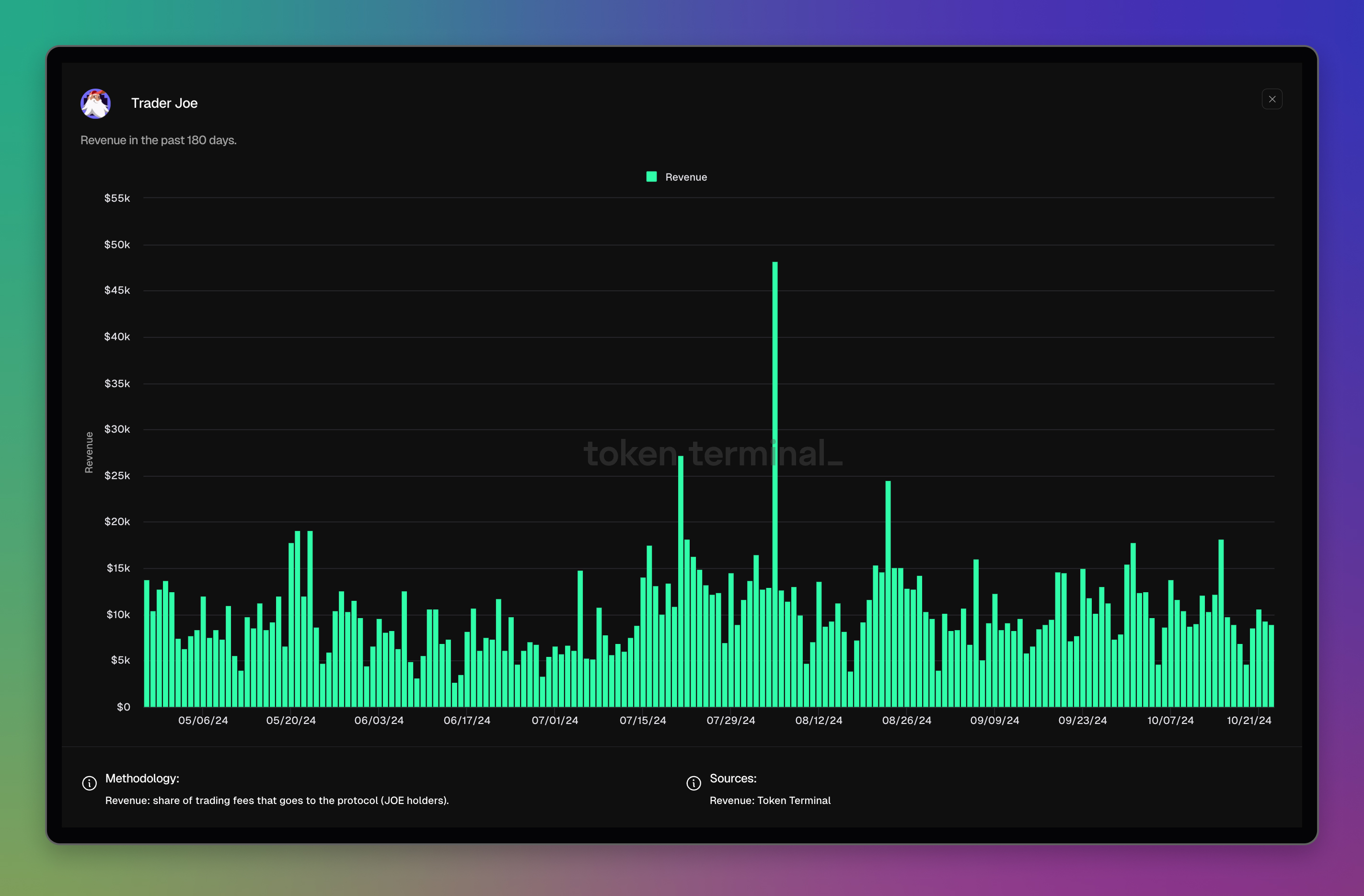

Revenue

What is this metric: Portion of fees kept by the protocol (and its tokenholders).

How it is calculated: Value of the fees kept by the protocol (and tokenholders), sourced from onchain data.

Why do we show it: Shows what percentage of the fees the protocol captures for itself.

Example:

Trader Joe dashboard: https://tokenterminal.com/terminal/projects/trader-joe

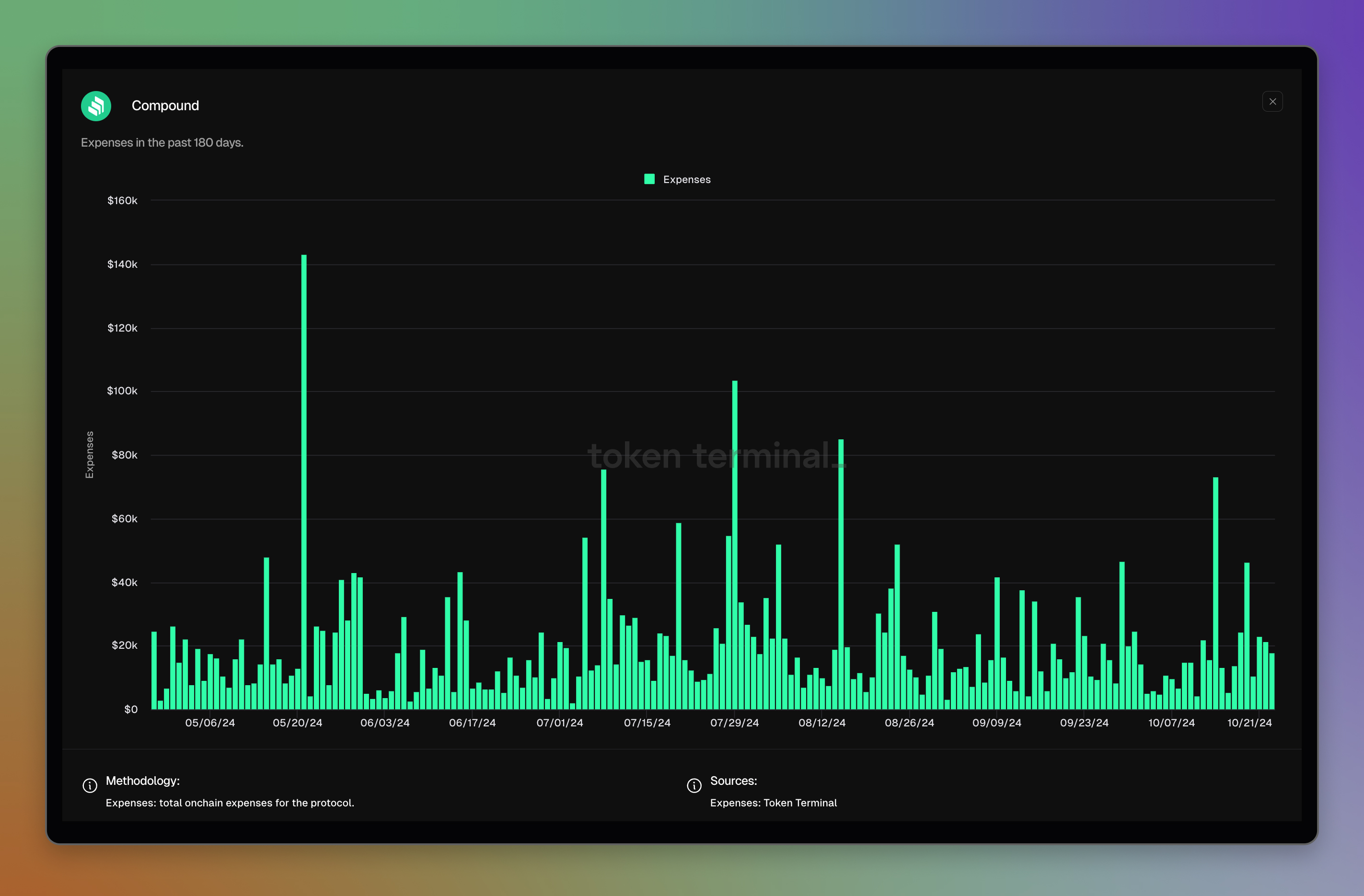

Expenses

What is this metric: Total onchain expenses paid by the protocol (currently includes only token incentives for most protocols).

How it is calculated: Sum of all expenses paid by the protocol, sourced from onchain data.

Why do we show it: This metric can be used to analyse the cost efficiency and economic sustainability of the protocol.

Example:

Compound dashboard: https://tokenterminal.com/terminal/projects/compound

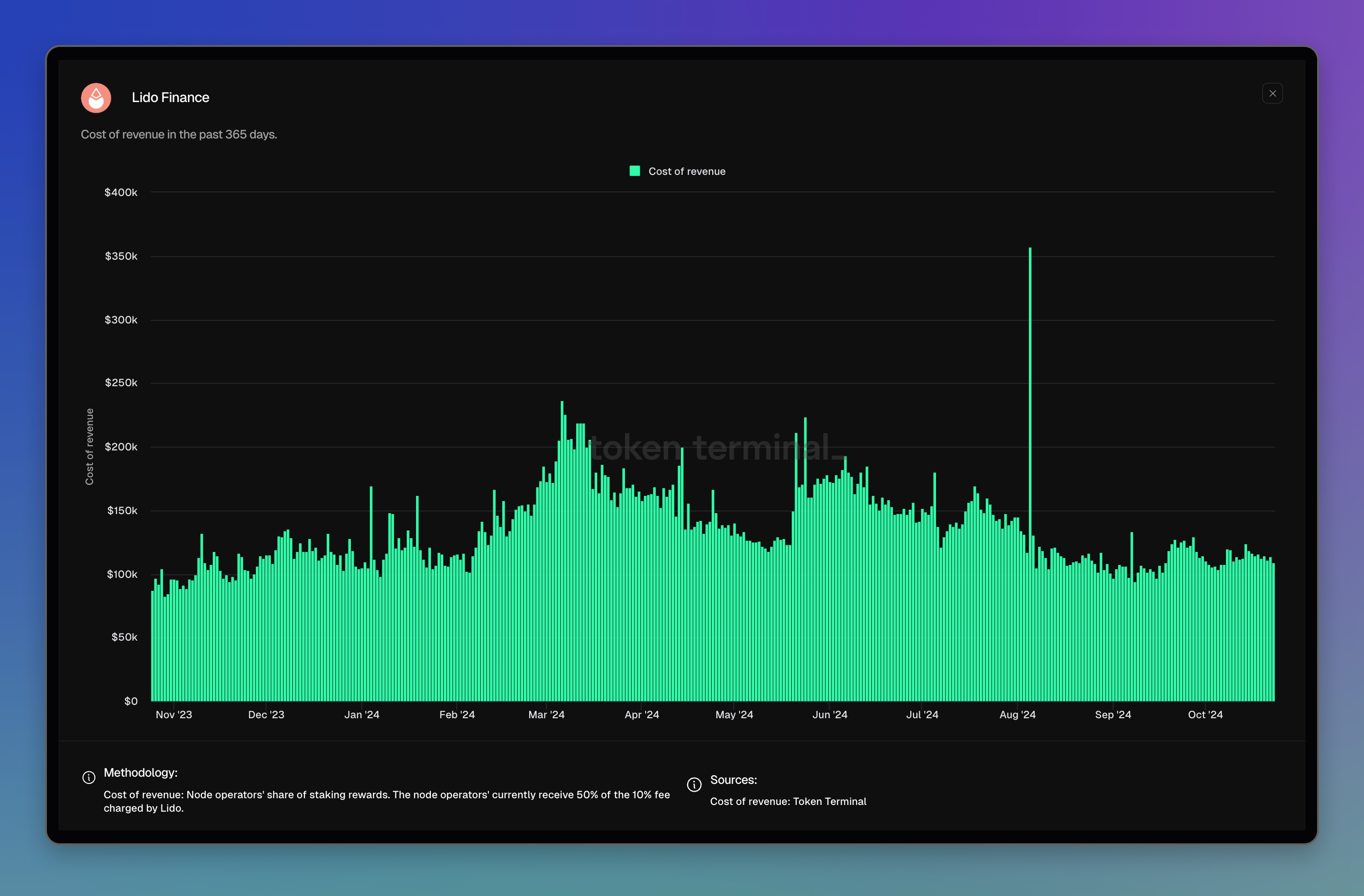

Cost of revenue

What is this metric: All onchain expenses directly related to the revenue generating service or product.

How it is calculated: Sum of all expenses directly related to the revenue-generating service/product. This could include L1 settlement costs for L2s or fee splits with service providers (e.g., node operators for a liquid staking protocol). This metric excludes token incentives (rewards) and operating expenses.

Why do we show it: The cost of revenue can be subtracted from revenue to calculate gross profit, which is a fundamental indicator of a company's profitability at the most basic level. A higher cost of revenue relative to revenue can indicate lower profitability.

Example:

Lido dashboard: https://tokenterminal.com/terminal/projects/lido-finance

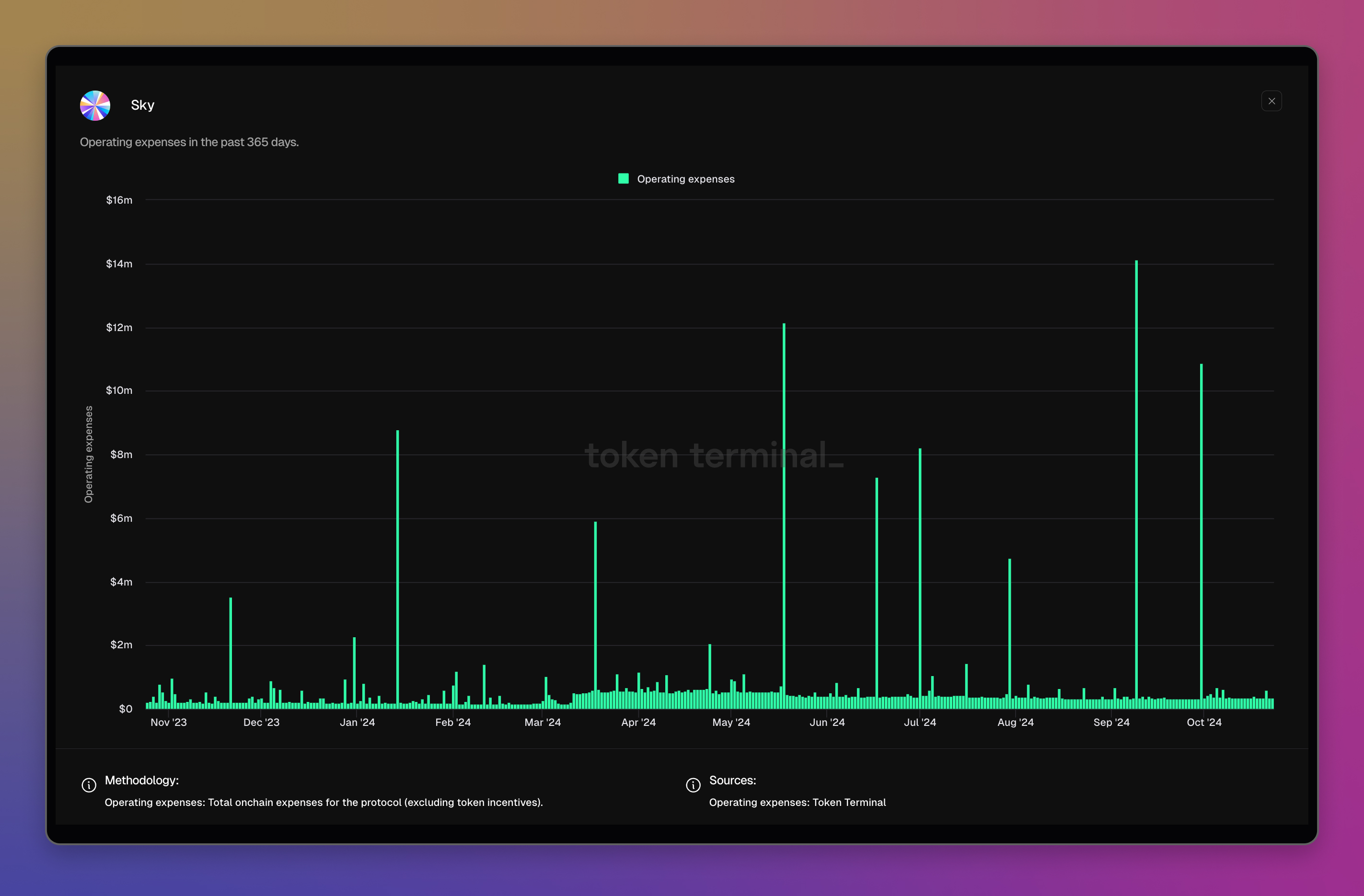

Operating expenses

What is this metric: All onchain expenses paid by the protocol, excluding token incentives.

How it is calculated: Sum of all expenses related to the operations of the protocol. This can include core team salaries, cost of goods sold, marketing expenses & partnership costs, sourced from onchain data. This metric excludes token incentives (rewards).

Why do we show it: This metric gives a proxy of how much it actually costs to operate the protocol. When comparing this metric with the revenue generated we can get an understanding of how economically sustainable the protocol is.

Example:

Sky dashboard: https://tokenterminal.com/terminal/projects/makerdao´

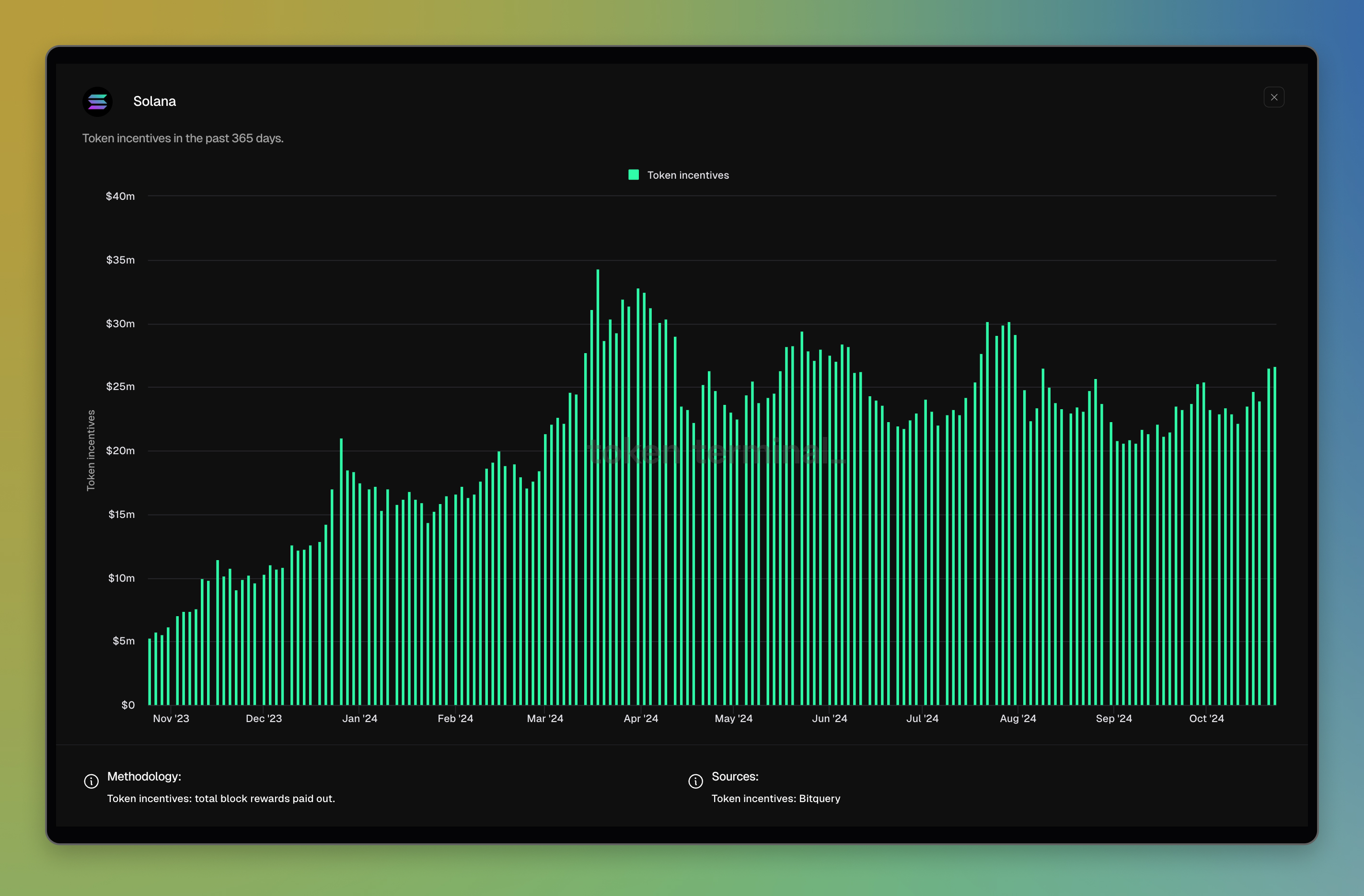

Token incentives

What is this metric: Governance tokens distributed to users (token-based compensation).

How it is calculated: Value of a protocol’s governance tokens that have been claimed by users, sourced from onchain data.

Why do we show it: Shows how much the protocol is subsidizing the use of the protocol by issuing tokens to its users, i.e. how much existing tokenholders are being diluted.

Example:

Solana dashboard: <https://tokenterminal.com/terminal/projects/solana>

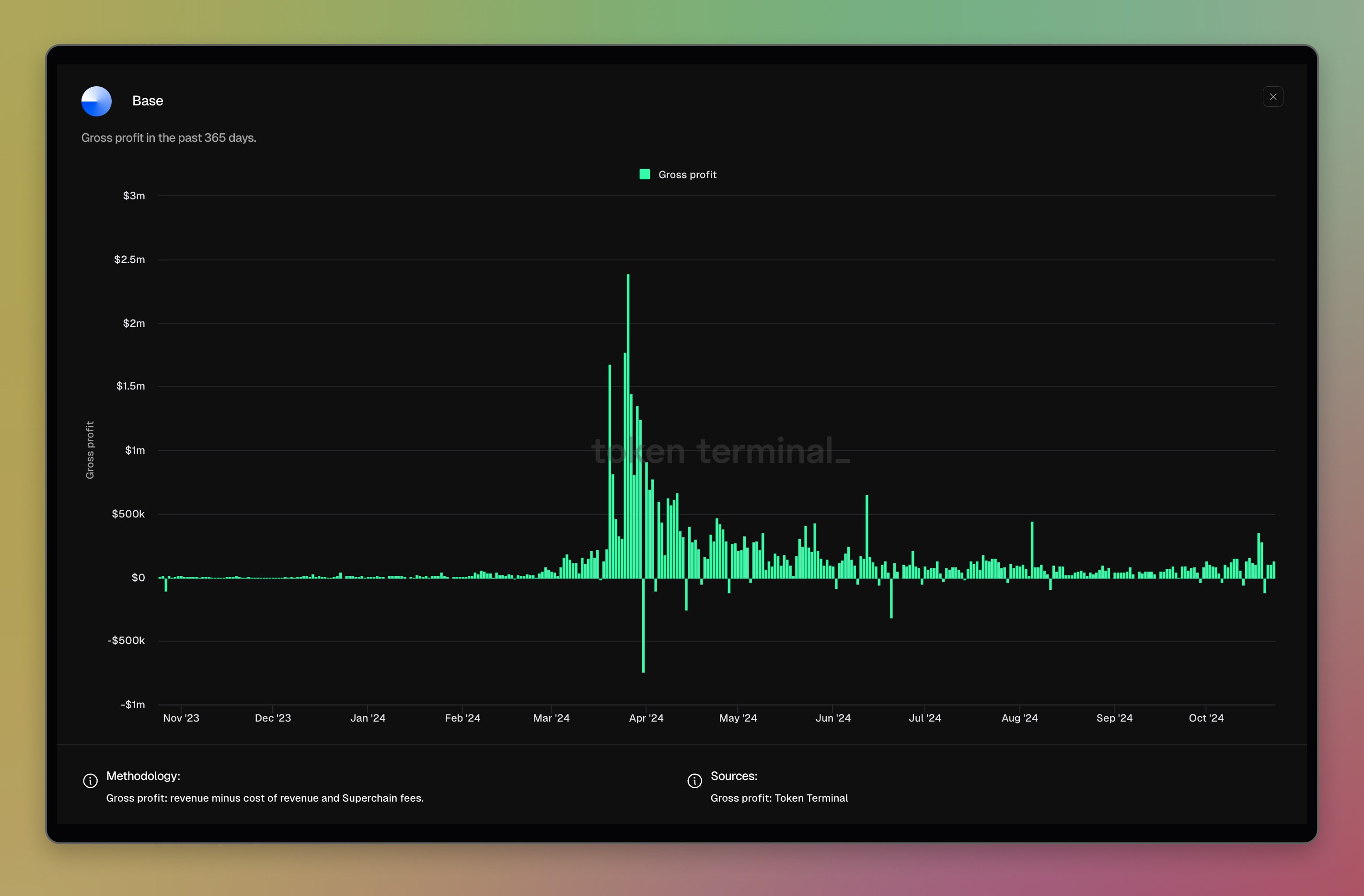

Gross profit

What is this metric: Gross profit is a protocol’s revenue minus its cost of revenue.

How it is calculated: Revenue - Cost of revenue, sourced from onchain data.

Why do we show it: This metric provides a proxy for how much is actually left after covering the direct costs associated with generating revenue. Gross profit is an important indicator of a protocol's profitability and efficiency in its basic operations.

Example:

Base dashboard: https://tokenterminal.com/terminal/projects/base

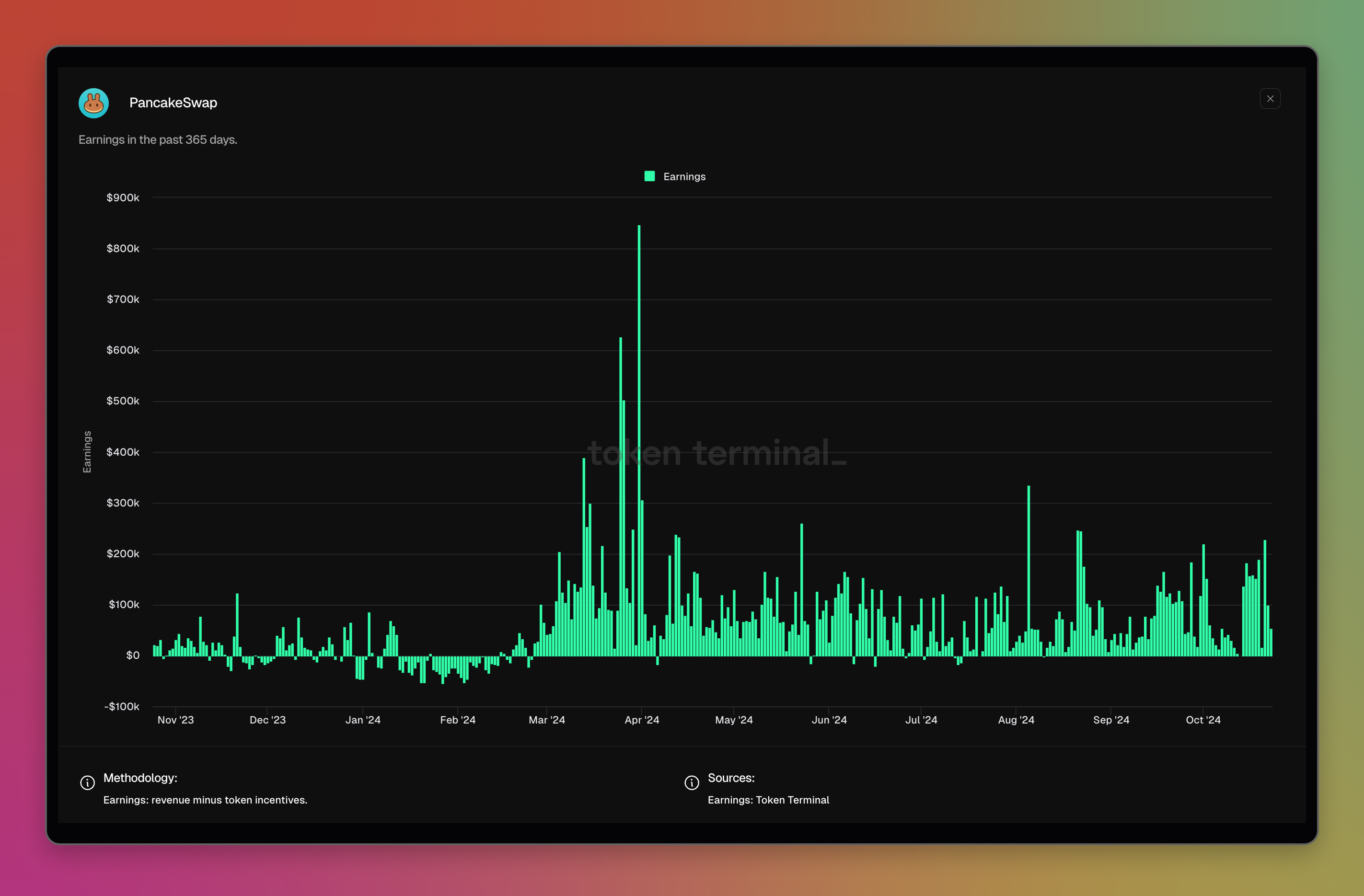

Earnings

What is this metric: Net income of a protocol (excl. off-chain expenses).

How it is calculated: Revenue - expenses, sourced from onchain data.

Why do we show it: Shows how much the protocol earns after expenses, i.e. if the protocol has an economically sustainable business or not.

Example:

PancakeSwap dashboard: <https://tokenterminal.com/terminal/projects/pancakeswap>

Updated 3 months ago